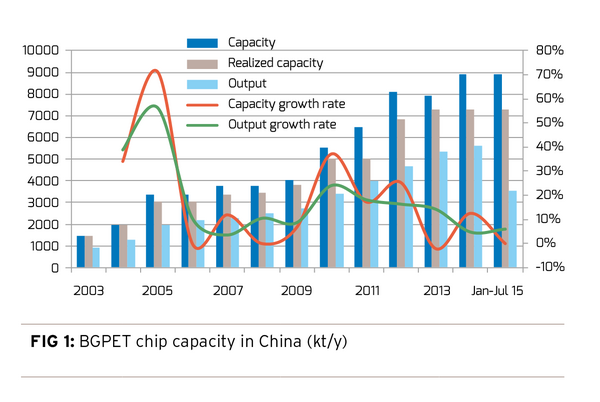

Expansion of bgpet chip capacity is faster than many other polyester products

After years of capacity expansion, China now has polyester capacity totaling 49.2 million tons/year, with 54.21 million tons utilized. Among it, BGPET chip capacity totals 8.91 million tons/year, with 7.28 million tons utilized, accounting for 16% of utilized polyester capacity. With comparatively short construction time and little investment, expansion of BGPET chip capacity is faster than many other polyester products, while growth of downstream demand was far lagged behind, causing increasing surplus. Nevertheless, BGPET production growth has been slowing down during recent years, with major suppliers running at low operating rate, and small-sized ones merged or weeded out. Still, there is huge pressure from capacity growth, with 500kt/yr of Wankai, 1,000kt/yr of Chenggao, and totally 800kt/yr of China Resources Polyester and Sanfangxiang likely to be commissioned in 2016.

BGPET chip capacity and pricing

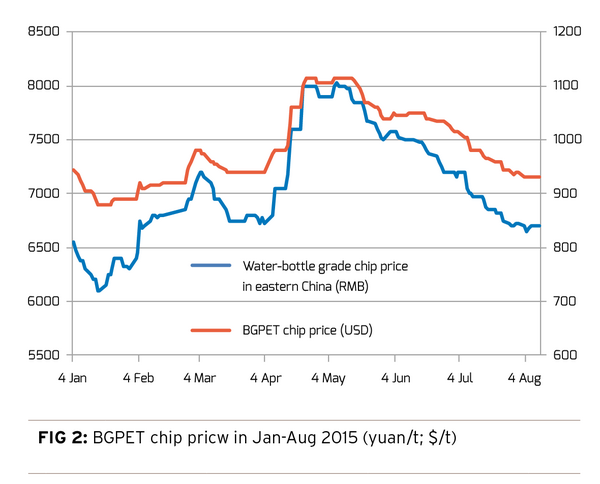

During H1 2015, BGPET chip market in China moved upwards at first and then downwards. In Q1, prices for water-bottle-grade chips in East China once fell to the historical low of 6,100 yuan/ton EXW in mid January. In early May, with blasts at several upstream plants tightening supply, BGPET chip prices saw a sudden rally with prices surging to 8,025 yuan/ton EXW, the peak year-to-date. In USD-based market, peak price appeared in late April to early May at $1,115/t, and bottom price in mid-to-late January at $880/t.

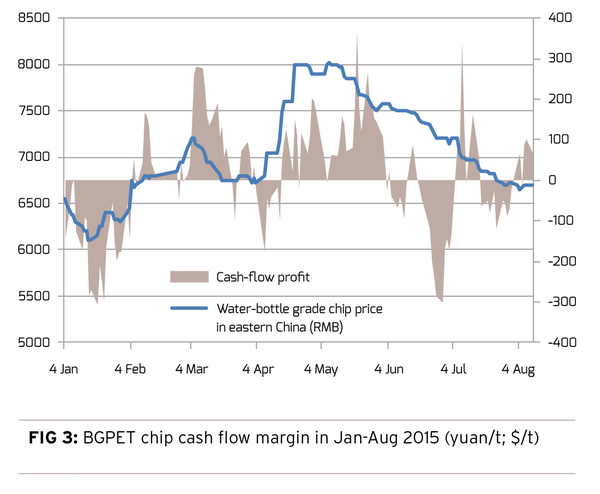

As for the margin, average margin based on raw material spot prices (hereinafter to be referred as spot cash flow) in H1 2015 was 11.1 yuan/ton, down 31.9 yuan/ton over the same period last year. In Jul-Aug, however, spot cash flow grew hugely to 37 yuan/ton, compared to -158 yuan/ton in the same period last year. In general, mid- and down-stream products in the polyester chain are making more margins this year mainly attributed to upstream weakness.

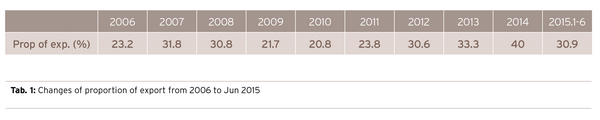

China heavily relies on overseas market to consume its BGPET chip output, with proportion of export ranging above 20% during 2006-2014. The proportion and export volume had been picking up as the impact from financial crisis faded after 2008. The proportion reached 40% in 2014, with huge export volume in spite of a slower growth. On the other hand, import volume had kept at a stable and low level in recent years.

However, above table shows that China’s BGPET chip export was challenged, as the proportion, export volume and growth rate all declined during H1 2015. Factors behind the declines include extremely huge export volume in 2015, other countries taking anti-dumping and anti-subsidiary actions against China’s exports, and geopolitical factors, such as the tension between Ukraine and Russia that caused shrinkage of exports to the two destinations.

Still, China maintains quite a few edges that ensure its position as an exporter, such as recent PTA expansions helping to lower production costs, and brand effect based on huge production and stable export volume. Besides, exports to Africa had been increasing in latest years. Nevertheless, with global market nearly saturated, it will be difficult to expand overseas market.

Finally, performance had been less satisfactory with our beverage industry during recent years, with most products witnessing slower year-on-year growth. The slow-down is mainly attributed to following factors: first, the weather; and second, safety. Growing concern in food safety in China recent years, rising from successive issues with juice, milk and other soft drinks, made consumers more cautious and selective. Another key reason is that policies and rules limiting consumption with public funds have reduced drink consumption, and the consumption is expected to shrink further given government’s resolution to carry on the measures. In H1 2015, the growth rate of China’s beverage industry was 5.4%, far below the 12% in H2 2014 but close to the whole-year growth rate of last year.

Though China’s BGPET chip makers currently enjoy decent profit, they will continue to face challenges amid unbalanced fundamentals home and abroad. The industry is entering a stage of correction, as the market will have to take time to absorb excess BGPET and upstream capacities. It is difficult to find highlight in a market with slow growth of end-user demand, which is in tandem with slower GDP growth, unless producers seek for new growth points through innovation. On the other hand, with the industry more concentrated in capacity and large-sized producers gaining pricing power, market prices will be more stabilized.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2024.