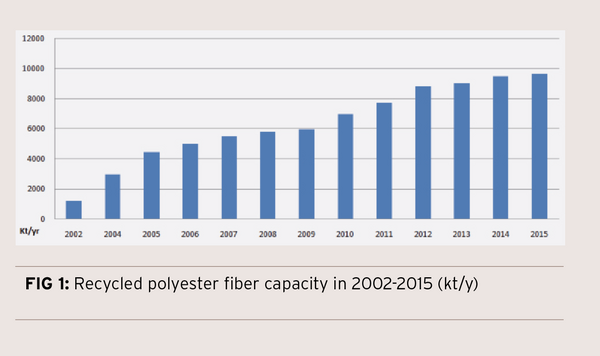

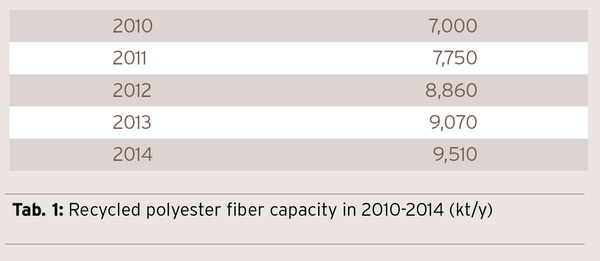

In 2015, the capacity expansion of recycled polyester fiber industry slowed down from the previous 1 million tons/year or so to the current 0.2-0.3 million tons/year, which was also seen in other industries.

According to the survey of S&P, due to dismal raw material and feedstock markets, it is predicted that investment of non-financial enterprises will drop by 1% in the world, extending the decline for the third consecutive year. Besides, the news of bankruptcy in chemical fiber industry was frequently heard.

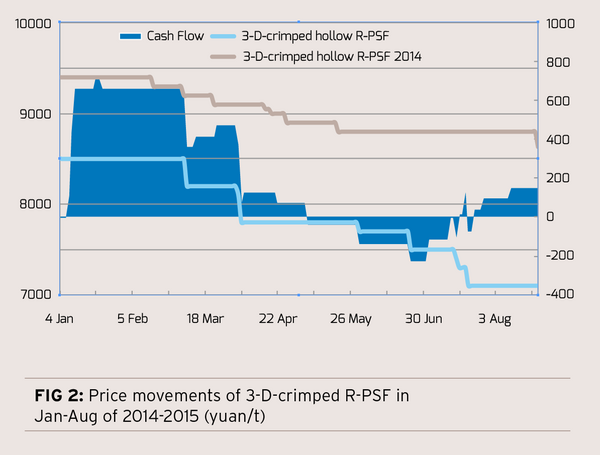

The following chart illustrates the movement of 3-D-crimped R-PSF market. From the chart, it can be seen that the market saw the price peak at the beginning of 2015, and then it went straight downwards, presenting an obvious downslide compared with the same period of 2014, with the gap generally at close to 1,000 yuan/ton, which showed signs to widen to 2,000 yuan/ton in recent days. As for profit margin, it was rich in the first half of 2015. It fell into the negative territory from May when the dull season came, while it recovered from July.

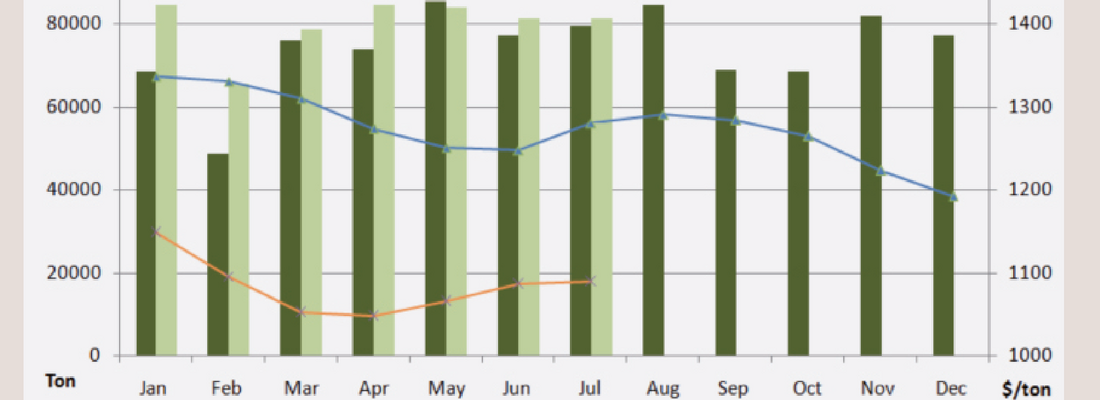

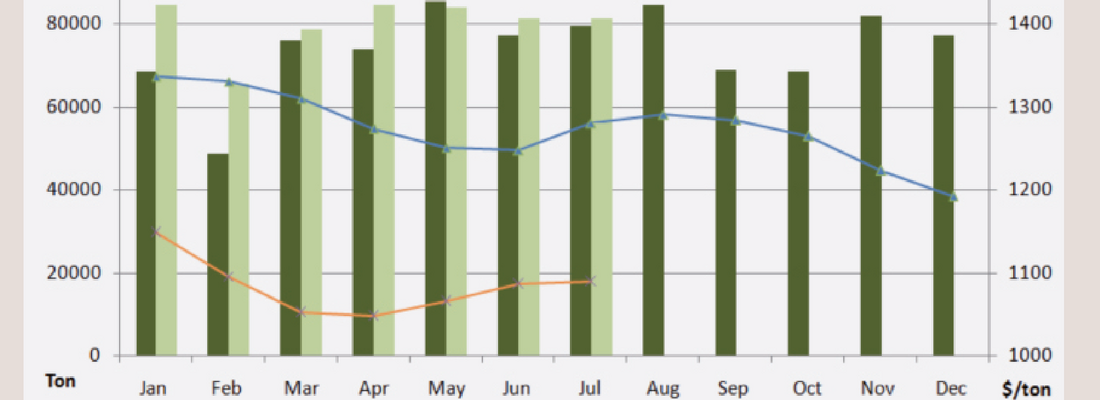

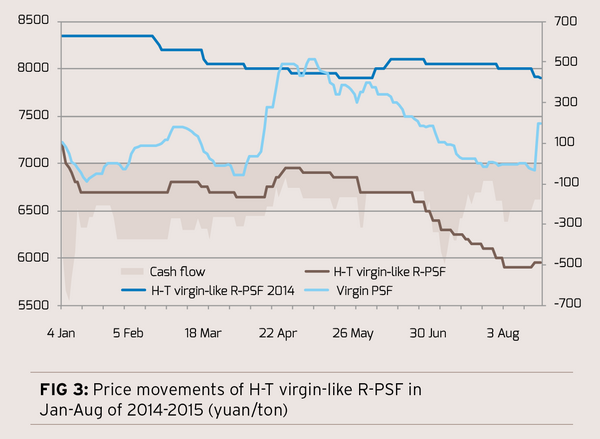

The following chart demonstrates the movement of high-tenacity virgin-like R-PSF market. It reads that the market also witnessed the peak at the year beginning, and then it fell back sharply, despite some fluctuations during the period. Compared with virgin PSF market, the price gap widened from the beginning of 2015 and was highlighted in April when virgin PSF prices climbed a lot on the news of PX unit explosion. Compared with the same period of 2014, the gap also stood at around 1,000 yuan/ton, narrowing in March to May while expanding again from June. And profit margin was mostly trapped in negative territory so far this year.

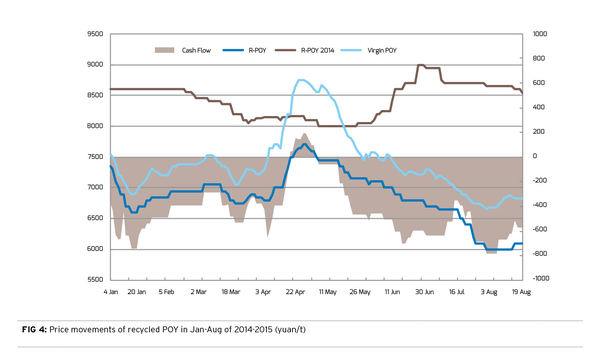

Next is the movement of recycled POY market, which was long-time in deficit. Its movement is highly related with virgin POY market. And compared with the same period of 2014, the price gap only narrowed in April when the broader polyester fiber market rose, while generally it stayed at 1,000-2,000 yuan/ton most of the time during the period.

Compared with the same periods of previous years, the prices of all varieties of recycled fibers slumped. And the price gaps with virgin products indicated that the prices of virgin products could swiftly shift downwards or upwards, while that of recycled products could hardly move up following declines, reflecting poor demand and resulting in losses. The change of the market spontaneously adjusted the growth rate of recycled chemical fiber capacities, which was painful for industry fellows, as this was not triggered by their initiative.

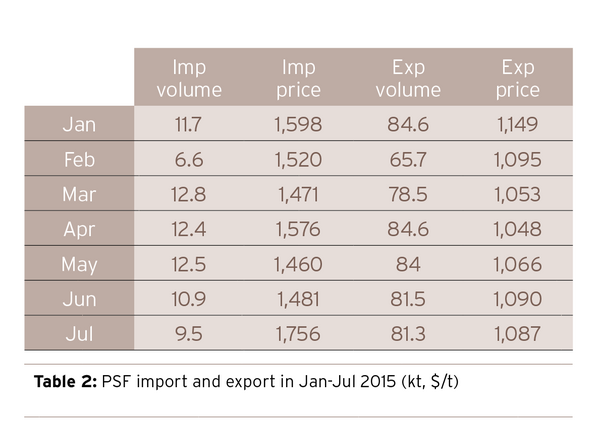

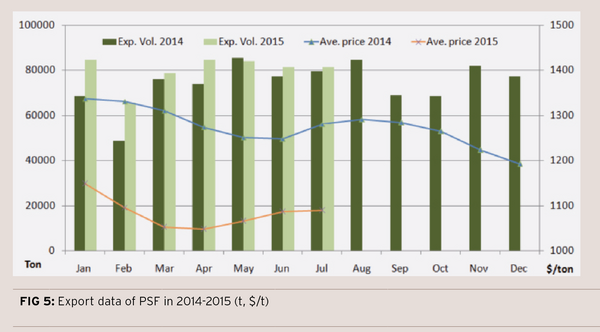

PSF export is mainly for R-PSF. From January to July in 2015, the cumulative export volume of PSF increases by 50.7 kt on a year-on-year basis, while the average export price falls by $203/ton.

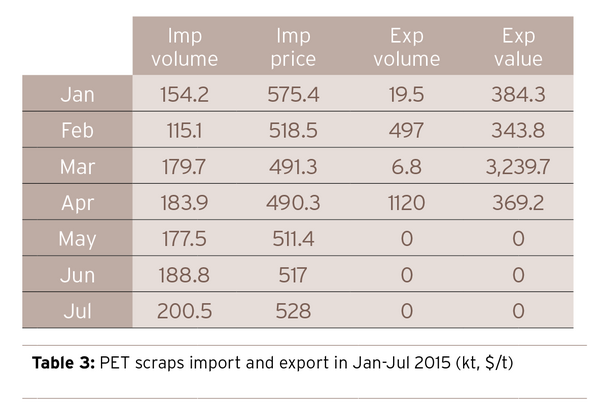

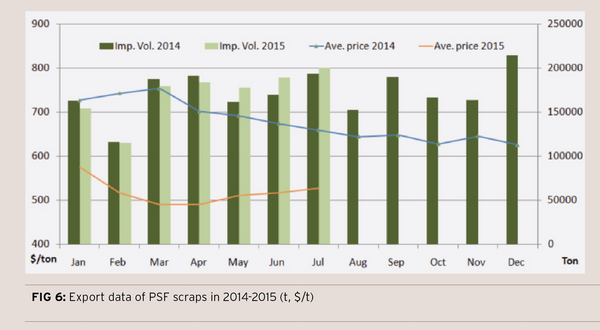

From January to July in 2015, the cumulative import volume of PET scraps ascends by 16.4 kt on a year-on-year basis, while the average import price drops by $187/ton.

It can be seen that the growth of import volume of PET scraps slackens, so does PSF export growth, with prices on the downside. Such phenomena coincide with the change of price and capacity domestically. Moreover, the slower growth of PSF export is reminding producers to pay attention to the losing competitiveness of homemade PSF in the international market, in addition to domestic competition.

The comPETence center provides your organisation with a dynamic, cost effective way to promote your products and services.

magazine

Find our premium articles, interviews, reports and more

in 3 issues in 2024.